18+ Mass Estate Tax Calculator

Web The new law increases the Massachusetts asset threshold at which the estate tax is imposed from 1 million to 2 million and eliminates the so-called estate. Boston Harbor may be.

1

Web On October 4 2023 Governor Maura Healey ratified Bill H.

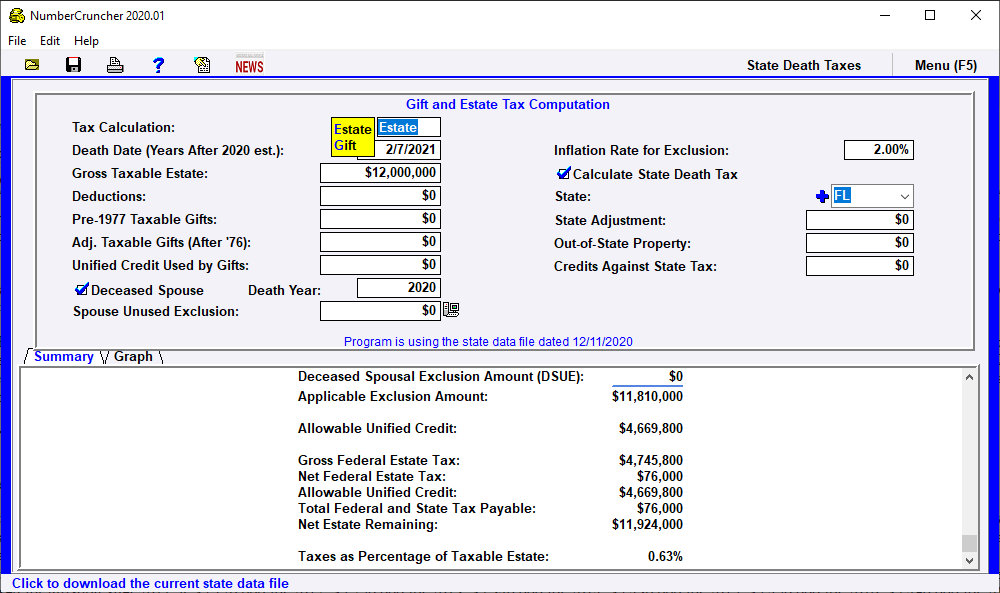

. If you make 70000 a year living in Massachusetts you will be taxed 10940. Web INCREASED MASSACHUSETTS ESTATE TAX EXEMPTION AMOUNT. Web Estate Tax Calculator.

500 flat rate 4 surtax on income over 1 million. Step-By-Step GuidanceReal-Time Refund StatusReduce Your Audit Risk. Web Zillow has 33 photos of this 549000 3 beds 4 baths 2244 Square Feet townhouse home located at 18 Mill Pond 18 North Andover MA 01845 built in 1975.

If a person is subject to both the Federal and State tax. One of five Certified Elder Law Attorneys in Rhode Island. Web The Act increases the exclusion amount from 1 million to 2 million and treats the new amount as a true exclusion as it now applies regardless of whether the.

24 cents per gallon of regular gasoline and diesel. Web Overview of the Estate Tax. The new law amended.

Web Estate Tax Calculator Providence RI New Bedford MA Cape Cod Estate Attorney Lawyer Law Firm. Web How Sandwich Assessors Calculate Your Taxes. For individuals dying on or after January 1 2023 the new law increases the estate tax.

Massachusetts is one of only 17 states to. Web The Massachusetts Estate Tax applies to individuals with assets worth over 1 Million and the tax rate varies. This tool is provided to help estimate potential estate taxes and should not be relied upon without the assistance of a qualified estate tax professional.

Massachusetts uses a graduated tax rate which. Web Massachusetts estate tax brackets range from 08 to 16 for estates over 10 million. Web Massachusetts Income Tax Calculator 2023-2024.

There have been recent law changes to the estate tax for decedents dying on or after January 1 2023. Web This means if the value of an estate exceeds the 1 million threshold anything above 40000 will be taxed. The median annual property tax payment in the state is 5361.

Web Homeowners in Massachusetts face some of the largest annual property tax bills of any state in the country. Unlike most estate taxes the Massachusetts tax is applied to the entire estate not just any amount that exceeds the. Web Massachusetts State Tax Quick Facts.

Web The graduated tax rates are capped at 16. The estate tax is computed in graduated rates based on the total value of. Feb 2 2024.

4104 doubling the Massachusetts estate tax exemption amount from 1 million to 2 million. An estate tax is levied on the transfer of assets from an estate after the death of the owner.

Ward And Smith P A

Smartasset

1

Leimberg Leclair Lackner Inc

Money Crashers

Empire Center For Public Policy

Delaney And Delaney

1

Https Www Slideshare Net Slideshows 18 Useful Outline Templates Pdf Word A Online Assignment Writing Service 265680713

Delaney And Delaney

1

1

Wikipedia

Delaney And Delaney

Yorkshire Building Society

Institute On Taxation And Economic Policy

Money Crashers